CONTRACTION

Weekly Briefing • December 8–14, 2025

Today, the Bittensor network crosses its first scarcity threshold. Unlike Bitcoin, this Halving is triggered by a circulating supply threshold rather than a fixed block height. Daily emissions drop from 7,200 to 3,600 TAO. This supply shock coincides with the activation of TFlow and Grayscale’s institutional entry, marking the final transition from a speculative bootstrapping phase to a real-value economy.

NEWSLETTER STATUS

Open Rate: 50.45%

Growth: 12 new subscribers this week. Welcome.

Thanks to your continued support, SubnetEdge has officially climbed to #40 out of 100 in the Technology category on Substack.

THE LEAD: The Mechanics of the Squeeze

The Setup D-Day is here. The Halving is triggered by supply thresholds rather than a fixed block count.

Emissions: 50% reduction in daily TAO issuance.

AMM Injections: TAO injection into subnet liquidity pools is reduced by 50%.

Alpha Rewards: ALPHA token rewards for miners and validators remain constant.

The Stakes With the activation of TFlow, Bittensor becomes a Darwinian filter. Emissions are now based on net inflows (staking) rather than just price. Only subnets capable of retaining capital will survive this reduction in incoming liquidity. As Const summarized: “Stop the revenue fetishism. Build real value.”

We analyzed how the technical shifts from last week’s TGIFT

THE ALPHA: The “Fat Stack” Thesis

The 49-page report released by Unsupervised Capital redefines the network’s valuation.

Price Target: $4,800 (Base Case) to $10,800 (Bull Case) by December 2027.

The Thesis: Bittensor is a decentralized Y Combinator. Just 4 or 5 “Breakout Winners” out of 100+ subnets are enough to carry the network’s valuation.

Fat Stack: Unlike Ethereum, Bittensor captures value at every level: every Subnet (App) success mechanically locks TAO (Protocol) into its liquidity pool.

INSTITUTIONAL SIGNAL: Grayscale ($GTAO)

On December 11, the Grayscale Bittensor Trust ($GTAO) began trading on OTCQX and became SEC-reporting.

Initial AUM: ~$10.8M.

Impact: The first US product offering direct exposure to TAO, marking the most viral signal of the week with 167k views.

NETWORK EVOLUTION: Major Technical Shifts

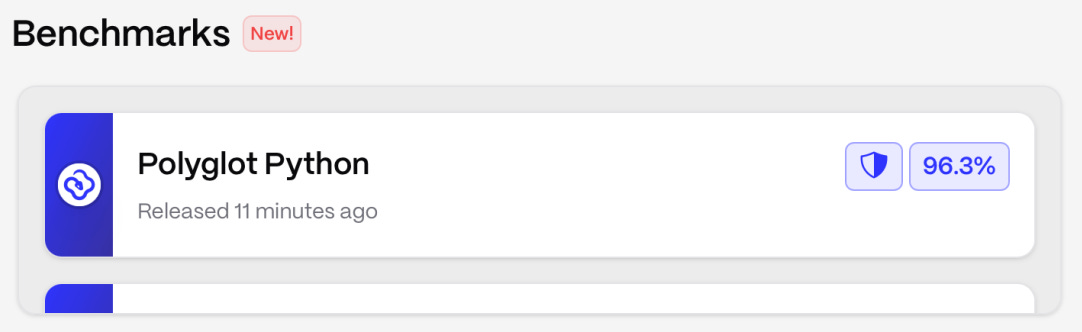

SN62 Ridges (Productivity)

Breaking Records: Their top agent just achieved SOTA levels with a score of 96.3% on Polyglot Python.

The Efficiency: High-end performance for a cost of only ~$11 per run, fully verifiable on-chain.

The Ratio: Their agents fix code 170x cheaper than GitHub Copilot.

SN64 Chutes (Infrastructure)

The Unlock: Launch of “Login with Chutes”, allowing developers to pass inference costs directly to the end user.

The Rank: Ranked #1 on OpenRouter by usage, Chutes already serves 110 Billion tokens per day.

SN81 Grail (Scale)

The Flex: Successful transition of 7B model training to full mainnet.

SN121 Sundae Bar (Agents)

The Pivot: Following an exchange with Const, the subnet is pivoting toward a single Unified Generalist Agent to concentrate R&D resources. Read here

SN78 Cartha (Liquidity Engine)

The News: The Cartha Testnet (UID 78) is officially LIVE.

Impact: Validation of 0x Markets liquidity models prior to production.

RAPID FIRE

DeFi: Launch of xSN9 on Base via AerodromeFi and Chainlink CCIP to make IOTA staking liquid.

Security: Activation of MEV Shield (encrypted mempool) by Const, allowing massive stakes without front-running risks.

Adoption: TAO.com app available on iOS (non-custodial). SubWallet now integrates ALPHA price charts.

New Subnets: Loosh (SN78) (AI Ethics via Yuma Group) and ForeverMoney (SN98) (On-chain liquidity management).

Products: Numinous (SN6) Oracle API (99%+ accuracy). Desearch (SN22) integrates real-time web search for autonomous agents.

Join the SubnetEdge community chat to receive real-time alpha and early network signals before they hit the headlines.

Have a good week !

Does this report add value to your decisions?

❤️ Like this post to support our economic intelligence work.

💬 Comment with your post-Halving strategy.

🔐 Upgrade to Premium for full strategic audits of the mentioned subnets.