REALITY CHECK

Weekly Briefing • December 22–28, 2025

While the market was digesting the holiday feast, the gap widened. On one side, those shipping critical infrastructure for enterprise. On the other, those being caught up by the post-halving economic reality.

TL;DR A quiet week on the surface, but brutal in the fundamentals. Opentensor locked down the network’s financial security with MEV Shield. Chutes #SN64 is outrageously dominating the news by connecting Bittensor to the real world (n8n). Conversely, Dojo #SN52 suspends operations, the first notable victim of this year-end economic rigor.

THE LEAD: Securing the Bag

With emissions stabilizing at 3,600 TAO/day, transaction security is becoming a major financial stake. On December 24, Opentensor Foundation activated the MEV Shield (Encrypted Mempool).

The Context: On Ethereum, MEV bots steal millions from users by manipulating transaction ordering (sandwich attacks).

The Update: Transactions on Bittensor are now encrypted until they are validated and included in a block.

The Impact: This is a major technical barrier against “invisible theft.” Unlike other chains where fees explode due to these bot wars, Bittensor keeps the value within the ecosystem for its real users.

THE ALPHA: Chutes #SN64 is the Captain Now

If you were looking for developer activity during Christmas, it was all happening at Chutes. They are currently dominating emissions and, more importantly, real-world usage.

The n8n Integration (The Bridge to the Real World) On December 23, Chutes launched Community Nodes for n8n (an automation platform used by 200k+ pros and companies).

The Value: An enterprise can now replace OpenAI with Bittensor in its workflows in just one click.

The Price: 70% to 85% cheaper than centralized giants.

The Killer Feature: Privacy via TEE (Trusted Execution Environments). Data is encrypted end-to-end; even the server provider cannot read it. This is exactly the argument Healthcare and Finance have been waiting for.

New Models & Performance

GLM-4.7 & MiniMax M2.1: Impressive scores (95.7% on AIME 2025) that are consistently beating Claude 4.5 on coding benchmarks.

NETWORK EVOLUTION

SN52 Dojo : The Shutdown

The Halt: Tensorplex announced the suspension of Dojo development on December 25.

The Reality Check: Despite hitting technical milestones, the economic equation no longer held up. The costs to prevent cheating (anti-gaming) outweighed the value generated. This is the “Great Filter” in action: only profitable models survive.

SN3 Templar x SN56 Gradients : The Alliance

The Collab: Gradients is now utilizing Templar’s decentralized infrastructure to optimize its models.

The Goal: They are aiming to train a 72B model entirely on Bittensor by early 2026. Proof that inter-subnet collaboration is starting to bear technical fruit.

SN93 Bitcast : The Data

The Metric: The subnet crossed 30,000 hours of watch time and saw +60% growth in two months. A goldmine of video data for future training.

⚡ RAPID FIRE

Marketing #SN16: BitAds is polishing its miner UI and finalizing data aggregation to prepare for its “proof-of-sale” phase.

Cross-Chain #SN106: VoidAI is preparing its expansion with Chainlink to bring liquid staking and interoperability in Q1.

Security #SN87: AceGuard confirms their validator code is ready. They are targeting the $6B online poker/e-sports market by detecting bots via behavioral analysis.

BioTech #SN68: Nova reveals “Boltzgen,” their new pipeline for generating nanobodies, forming the basis of their upcoming third mechanism.

Launch: SubnetEdge Recon

Imagine betting on a football team by looking only at its results from 3 months ago, without knowing that yesterday, it lost its 3 best players. That is exactly what you are doing if you invest in Bittensor by looking only at official data.

This weekend, we had to update our models following a technical confirmation from the founding team.

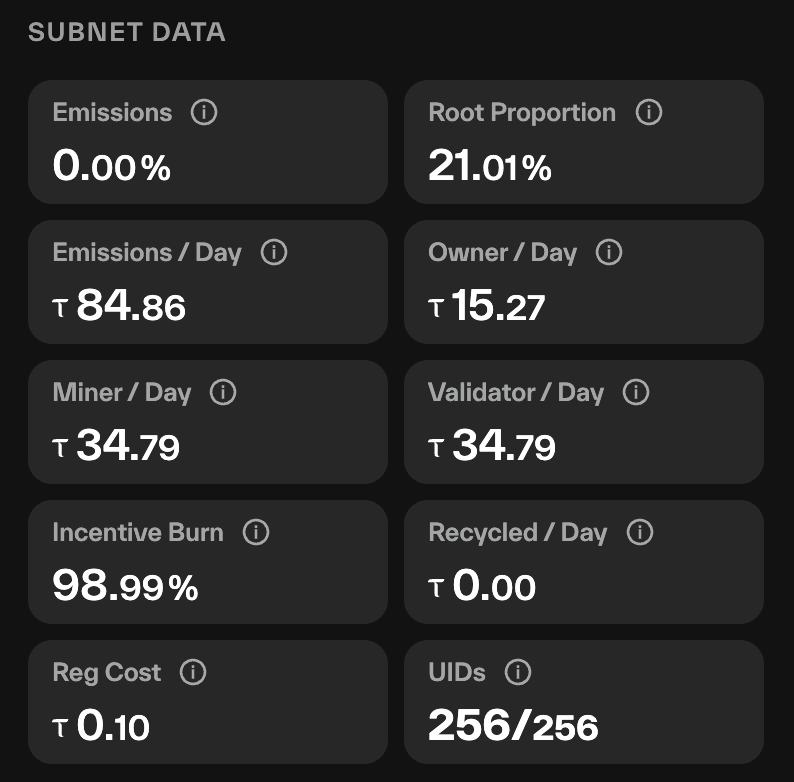

1. The 86 days (Correction: Flow or Die)

In our last report, we estimated that the system reacted in 30 days. That was an underestimate. The protocol smooths performance (emissions) over an average of 86 days.

The Sports Analogy: The “Score” displayed on Taostats is not the result of yesterday’s match. It is the average of the team’s scores over the last 3 months. If a team collapses today, its official score will remain high for weeks thanks to its past victories.

2. The Rich Club That Doesn’t Win Anymore

Why do “dead” Subnets stay alive? Because “Relegation is based on Price, not Emissions.”

Let’s look at the case of Subnet 41 (Sportstensor) yesterday:

The General Standings Taostats: The club is rich. It still has a large market cap, so it keeps its spot in the League. It appears “Safe” and ranked #19.

The Real Form (Our Recon Radar): On the field, it’s a disaster. The team isn’t scoring any goals (0.00% emissions) and the fans are returning their season tickets (-11,930 TAO outflow).

It’s a “Zombie”: a club that no longer generates wins (yield) but lives on its past glory.

3. The Inverse Opportunity: The Invisible Comeback

This is where it gets interesting for you. The lag works both ways.

Imagine that tomorrow, this Subnet 41 wakes up and suddenly attracts +50,000 TAO (new coach, new tech).

The Official View: Will continue to display mediocre stats for weeks, weighed down by its history of defeats. The crowd will think the team is still bad.

Our Radar: Will see immediately that the dynamic has reversed.

This is the essence of our service: allowing you to identify the team that starts winning before the official standings show it.

4. How to see the Match Live?

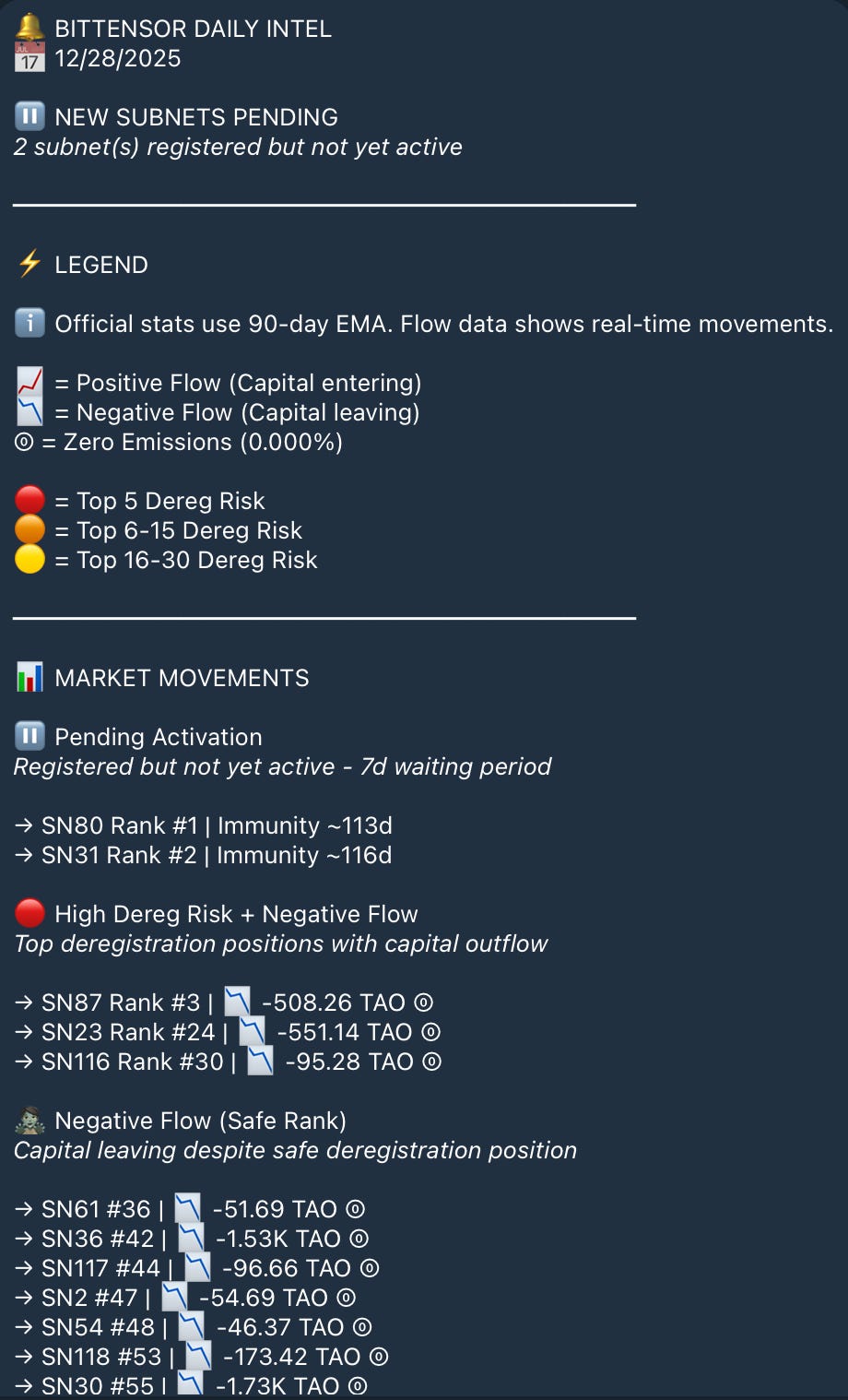

This is why we are launching SubnetEdge Recon. A daily Telegram report that ignores the “smoothing” to focus on Raw Flow.

It serves two purposes for you:

🛡️ Monitor to Act: Identify Zombies whose fundamentals are collapsing, to make your decisions before the value drops.

🚀 Play the Comeback: Spot the subnets receiving massive capital today, before the official curve goes up.

LAUNCH OFFER: Access is Included

We are launching SubnetEdge Recon for a simple reason: to give our community an advantage.

Rather than selling this tool separately, we decided to include it directly in your subscription.

If you are a paid subscriber to this newsletter ($8/month):

✅ Access to the “Recon” Telegram channel is INCLUDED for you.

✅ It will remain so as long as your subscription is active.

Now is the ideal time to subscribe. You fund independent research, and you get a surveillance tool that is worth far more than the price of the subscription.

How does it work?

New Subscribers: As soon as you sign up via the button below, we will automatically send you your personal invitation link.

Current Subscribers: Keep an eye on your inbox; you will receive your exclusive access link in the next few days.

Does this report add value to your research?

If so, here are 3 ways to help us maintain this standard of intelligence:

❤️ Like this post to help the algorithm signal it to other serious investors.

💬 Drop a comment with your questions or counter-arguments (we read every single one).

🔐 Upgrade to Premium to unlock the full strategic audits, technical deep-dives, and the complete archive.

Has the Recon display any daily report so far. Mine has no report.

Updates came in today and it’s a real eye-opener. It’s both in English in Spanish and it goes through what is failing what is safe and what is making money take your time on it and really read into it.