MEV ALERT: EXPLOIT

“Risk-Free” Piracy: How a priority loophole cost the community 200+ TAO ?

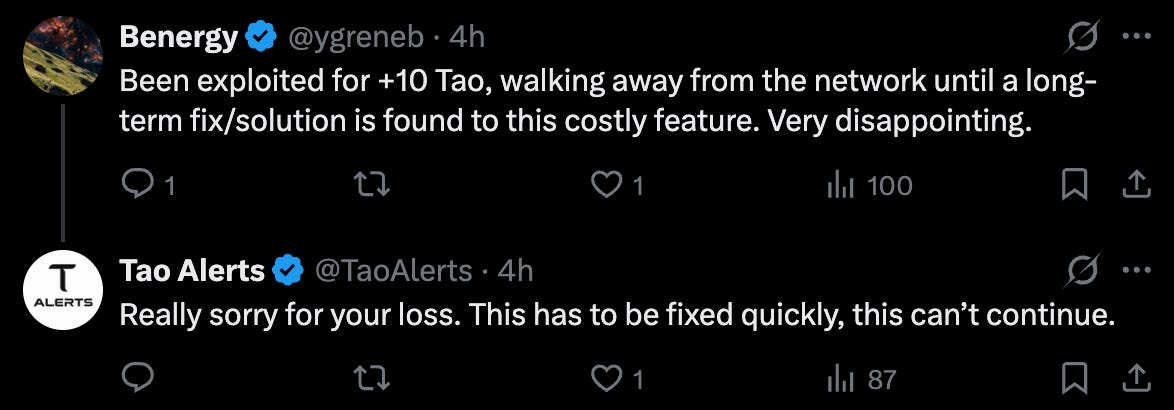

The alert issued by TaoAlert today has reached the highest levels of the ecosystem. Jacob Steeves, founder of Bittensor, has just confirmed the nature of the exploit used to siphon over 200 TAO.

The Exploit: “Ghost” Transactions

This wasn’t a brute-force attack, but a sophisticated manipulation of transaction priority on-chain.

“It was an interesting exploit that allowed MeV’rs to cancel their own transactions (if they are not profitable) by gaming the chain transaction priority.” — Const

What this means in plain English: Usually, a MEV bot takes a risk: if it tries to front-run you and fails, it loses gas fees or gets stuck with a losing position. Here, the bots found a “free cancel button.” They could attempt to attack you, and if the trade wasn’t profitable within a micro-second, they simply aborted the transaction at no cost.

This is risk-free piracy. And that’s why it was so effective today.

The Resolution Plan

The Fix: A protocol-level update is being engineered to fix the priority logic.

Timeline: Const expects a solution within the next few days.

Tactical Advice /The 48-72h Window

Until the official patch is deployed, the loophole remains technically open. We recommend extreme caution for the next 72 hours:

Tighten Slippage: Setting slippage to 0.1% makes the attack significantly harder to execute profitably.

Fragmented Transactions: Large transactions are the primary targets for these ghost transactions. Break them down.

Constant Monitoring: We are tracking the

subtensordeployments minute by minute.

The network’s Protective Inertia (EMA) stabilizes your yields, but only rigorous transaction management will protect your principal from these predators.

Stay sharp. The patch is coming.

Source:

The riskfree cancel button is such a clear articulation of why this exploit was so damaging. Normal MEV involves some skin in the game, failed attacks cost gas or leave you holding bags. But gaming transaction priority to abort unprofitable moves at zero cost flips the entire risk model. Reminds me of flash loan attacks except even cleaner since there's no capital requirements, just pure informational asymmetry with a costless undo mechanism.