GTAO : The 227% Anomaly

Why Wall Street is Paying a Luxury Premium for Bittensor ?

Grayscale’s “2026 Digital Asset Outlook” report is definitive: we have entered the institutional era of digital assets. By identifying the centralization of AI as a critical global risk, Grayscale has positioned protocols like Bittensor as vital infrastructure for the future.

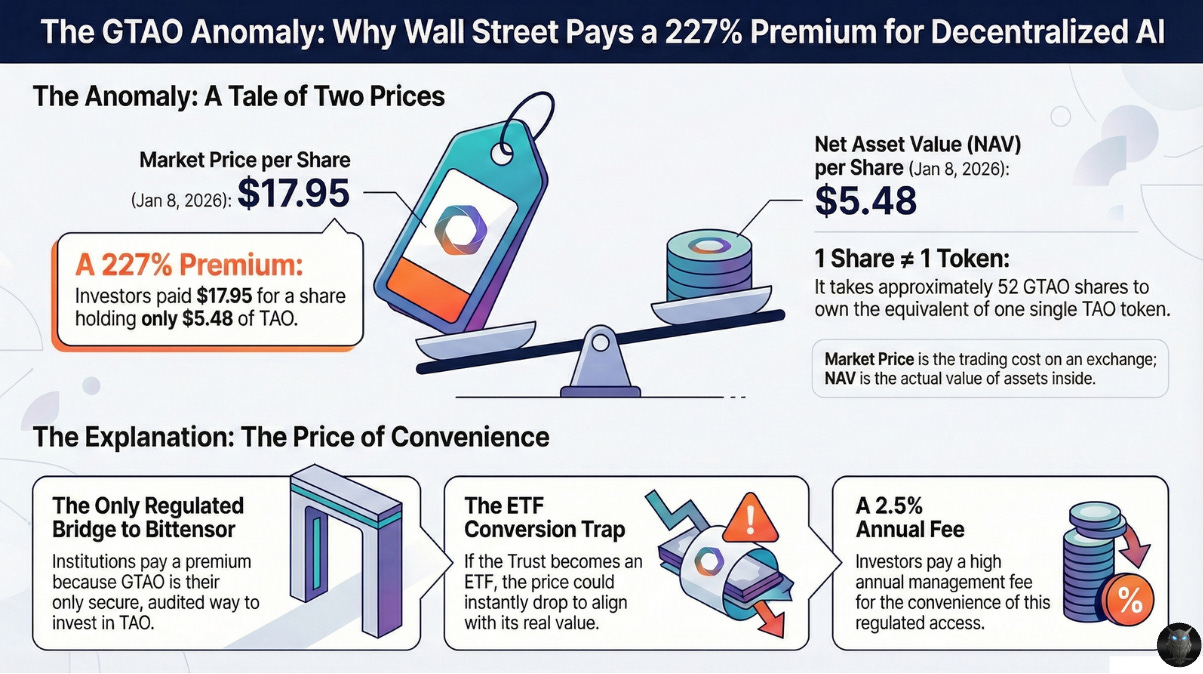

The ticker symbol GTAO is the financial translation of this thesis. While it appears on bankers’ terminals daily, its underlying mechanics remain obscure to many. As of January 8, 2026, a striking disconnect emerged: investors are paying $17.95 for a share holding only $5.48 worth of TAO—representing a 227% premium.

Let’s decrypt these financial mechanics to understand why Wall Street is currently paying triple the price for exposure to Decentralized AI. Between the 2.5% annual management fee and the fact that it takes approximately 52 shares to own the equivalent of a single TAO token, we analyze how this regulated product is setting the stage for the next major pivot: the conversion to a Spot ETF.

The Architect: Grayscale and the Return of Barry Silbert

Grayscale acts as the universal translator of finance, wrapping complex digital assets into regulated stocks. Behind this machine is its founder and owner, Barry Silbert.

A pioneer who seeded his first Bitcoin fund in 2013 when few saw its value, Silbert has shaped the contemporary crypto arena by funding over 150 companies. After resigning in late 2023 amid legal pressure, Silbert officially returned as Chairman of Grayscale’s board in August 2025. His return, occurring alongside a push for an Initial Public Offering , signals a renewed conviction in the next phase of digital assets. Just as he championed Bitcoin’s institutional adoption, his leadership now supports the integration of Bittensor into the global financial fabric through the GTAO Trust.

The Vault: Understanding the GTAO Trust

The Math: How Much TAO Per Share?

To avoid being misled, investors must understand the ratio. One GTAO share does not equal one TAO token. Each share represents a tiny fraction of the vault’s holdings.

The Ratio: As of early January 2026, the ratio is 0.01922571 TAO per share.

The Reality: To own the equivalent of one whole TAO token through this product, you would need to purchase approximately 52 shares of GTAO.

The Anomaly: Market Price vs. Net Asset Value (NAV)

This is where traditional financial logic meets the reality of institutional demand. There are two distinct prices for the same asset:

The Real Value (NAV): If the vault were liquidated today, each share would be worth exactly $5.48.

The Market Price: Yet, on stock exchanges, investors are buying these shares for $17.95.

The “Comfort Tax”: Wall Street is paying a 227% premium. This reflects the massive institutional appetite for Bittensor and the willingness of funds to pay for the “wrapper” when they cannot legally hold the “content” directly.

The Catalyst: Conversion to a Spot ETF

The most significant development for 2026 is Grayscale’s S-1 filing with the SEC to convert this Trust into a Spot ETF.

The Arbitrage Mechanism: Once converted, “Authorized Participants” will be able to create and redeem shares in exchange for real TAO tokens.

The Impact: This will instantly collapse the premium, aligning the share price ($17.95) with the real value ($5.48). While this represents a risk for current premium buyers, it is a major milestone for the asset’s liquidity and long-term stability.

Management Fees

The convenience of a regulated product comes with a cost. Grayscale charges a 2.50% annual management fee. This fee is deducted daily from the amount of TAO held by the Trust, which causes the TAO-per-share ratio to decrease slightly over time.

The EDGE Verdict

The existence of GTAO is a monumental victory for the Bittensor ecosystem. It serves as a bridge of trust, signaling that Decentralized AI is no longer a laboratory experiment but a legitimate institutional asset class.

GTAO offers two distinct paths for the modern investor:

The Institutional Path (GTAO): Ideal for those prioritizing regulatory compliance, tax-advantaged accounts (like IRAs), and the simplicity of a brokerage account.

The Sovereign Path (On-Chain): For those who prefer direct interaction with the protocol and want to avoid the “premium” costs of traditional finance.

https://www.google.com/finance/quote/GTAO:OTCMKTS?hl=fr

Whichever path you choose, the key is understanding the tool.

Expert Note: For those choosing the path of technical sovereignty and looking to master direct ownership, our colleague Brian has done an exceptional job detailing the nuances of Bittensor wallets. His guide is an essential resource for navigating this ecosystem with precision: Brian’s Bittensor Wallet Analysis.

Activate MAESTRO: Your Bittensor Research Agent

Included in your Subnet Edge Alpha subscription.

Bittensor lives on Discord. With 128 subnets, each managed by dedicated teams across hundreds of specific channels, the information flow is a chaotic jungle. Delegate the social and technical monitoring of this ecosystem to MAESTRO’s intelligence.

Agent works for you 24/7:

🤖 MAESTRO Intel (Telegram): Your agent continuously processes Discord signals and TAO capital flows across every subnet. Every day, it delivers a comprehensive diagnostic: Smart Money detection, Whale Exits, and Deregistration Risk alerts based on real-time API data.

🔬 Subnet Forensics: A surgical analysis of the technical viability and economic performance of the most promising subnets.

📡 The Weekly Pulse: A professional-grade, condensed briefing on critical network movements and governance shifts to ensure you never lose the thread.

Your Benefit: Reclaim 10 hours of research per week

While the market relies on public data smoothed over 90 days, MAESTRO gives you access to raw and immediate API data. Don’t just read the news—precede it.

If so, here are three ways you can support our work and make the most of your subscription:

❤️ Like this post: It’s a simple gesture that greatly encourages us to keep producing this in-depth analysis.

📢 Share the article: If you know a serious investor looking to master Bittensor fundamentals, feel free to share this report with them.