DYNAMIC MANAGEMENT

Weekly Briefing • Feb02, 2026 – Feb 08 2026

TLDR

On this network, you are either at the table or on the menu. This week, Chutes (SN64) reminded everyone what holding an unfair advantage looks like with emissions climbing to 13.68%, while Cartha (SN35) laid the first brick of real-world finance with 111,187 USDC locked. Infrastructure is hardening, margins are tightening, and those who fail to see the next move are already out of the game.

Bittensor is no longer a sandbox for developers seeking grants. We have entered the phase that separates those making noise from those making money. The Physics of Computation is not an abstract concept; it is a guillotine for the inefficient.

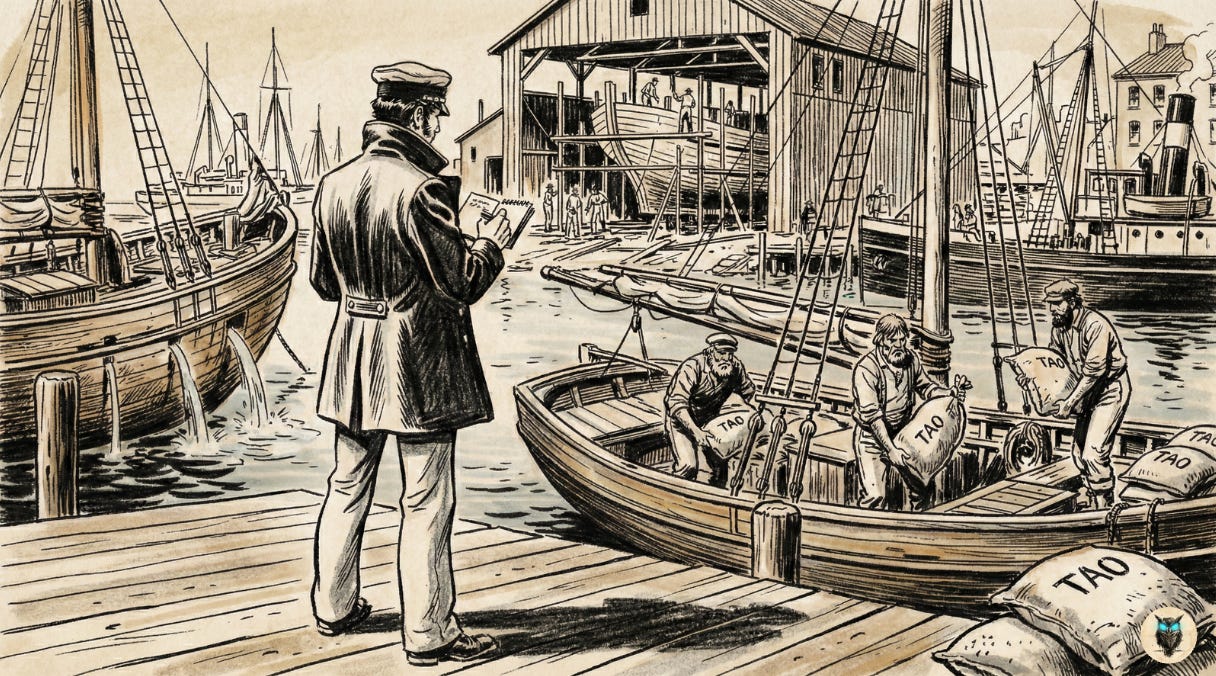

Capital does not move by chance. It seeks fortresses. This week, TAO flows shifted away from marketing narratives toward locked, secure, and profitable infrastructure. If you manage your portfolio by instinct or emotion, you have already lost.

At SubnetEdge, we don’t look at charts; we look at foundations. You either own the infrastructure, or you pay for it. Choose your side.

A debrief on the 0xMarkets ( Cartha SN35) playbook, featuring the exceptional Raleigh.

Exclusive to Subscribers: Decoding the DSV Fund x MentaMinds investment playbook, 3 high-conviction subnets on our radar, and an deep dive into Leadpoet the ultimate commercial war machine.

Menta Minds at DSV FUND

The recent exchange between DSV Fund and Gustave from the Menta Minds team regarding Bittensor investment aligns perfectly with how we process data and flows daily. The era of buy & hold on the Top 10 is fading, replaced by dynamic management rooted in game theory.