A First for DePIN: SEC Recognizes Service-for Token Model

Work performed, service rewarded. The model gets regulatory backing

🎯 Introduction

The SEC issued a no-action letter to DoubleZero, a DePIN project.

The question: does this open the door for Bittensor?

🧩 Context / Facts

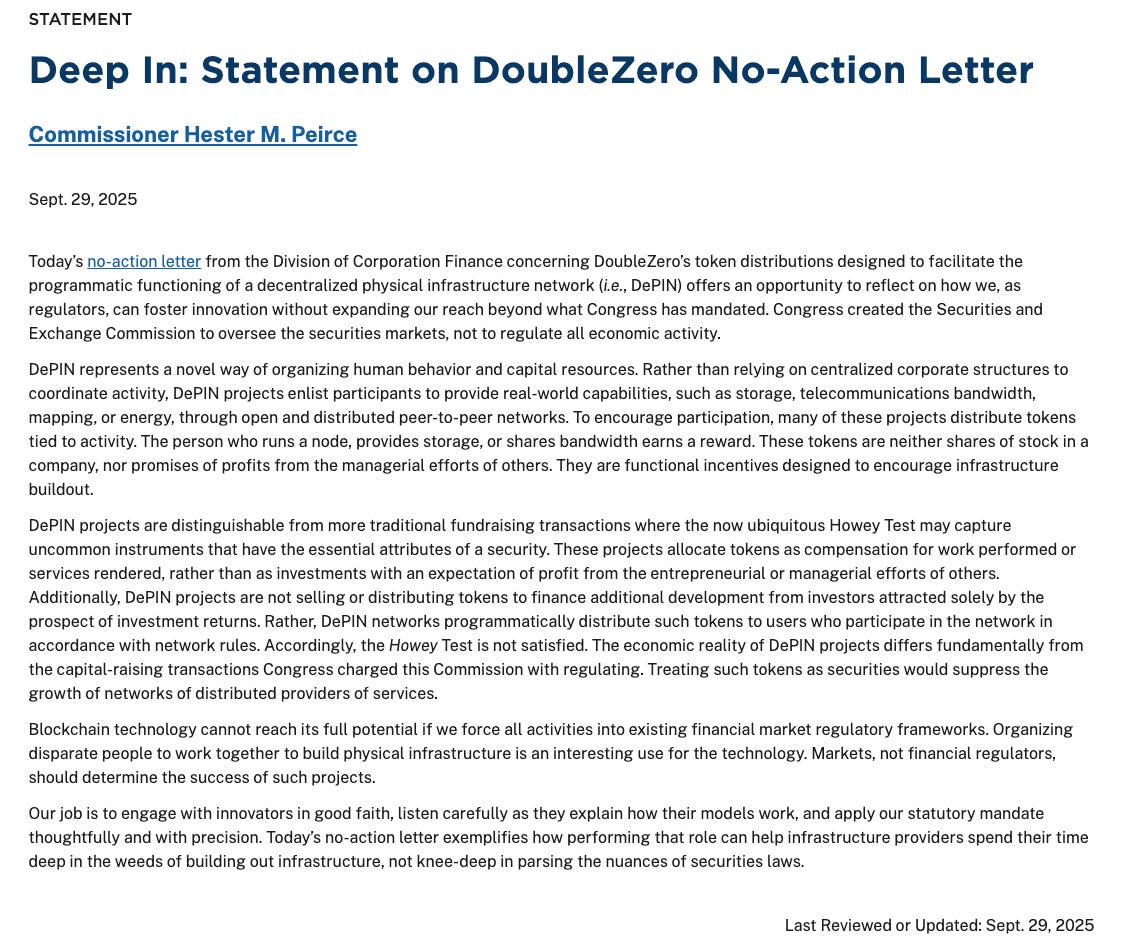

September 29, 2025: the SEC grants a no-action letter to DoubleZero.

DoubleZero = decentralized fiber network, 2Z token distributed as a utility reward.

The SEC confirms 2Z is not a security in this setup.

Immediate reaction: DePIN trading volumes up, including Bittensor’s TAO.

🚀 Opportunities for Bittensor

Regulatory acknowledgment that DePIN tokens can be “functional rewards.”

TAO can argue it pays for service, not speculation.

Adds credibility to DePIN narratives with institutional investors.

Lower perceived legal risk could attract more developers and operators.

⚠️ Limits & Risks

The letter applies only to DoubleZero, not the whole sector.

Each project must defend its model in front of regulators.

Bittensor must show TAO is distributed automatically, not sold as an investment.

Risk of relying on a one-off case if the SEC shifts its stance.

🔮 Analysis / Outlook

DoubleZero marks a turning point: first clear recognition of a DePIN model.

For Bittensor, it’s a strategic narrative boost, not a legal shield.

Key question: will the SEC replicate this for other DePINs, or keep it an exception?

📝 TL;DR

SEC validates DoubleZero’s token as non-security.

Bittensor can leverage the precedent, but nothing is guaranteed.

Future depends on whether DePIN projects prove their models.

🤝 Conclusion & CTA

The regulatory battle is moving into DePIN.

Subnet Edge will track how DoubleZero impacts Bittensor and TAO.

Subscribe to stay ahead of the next signals.